Carbon Markets Aren't Optional Anymore: What Founders and Operators Need to Know

As carbon markets evolve from niche environmental mechanisms to mainstream business considerations, organizations need robust operational strategies to navigate this complex landscape. This article explores how to build effective carbon management systems that align with both regulatory requirements and strategic business objectives.

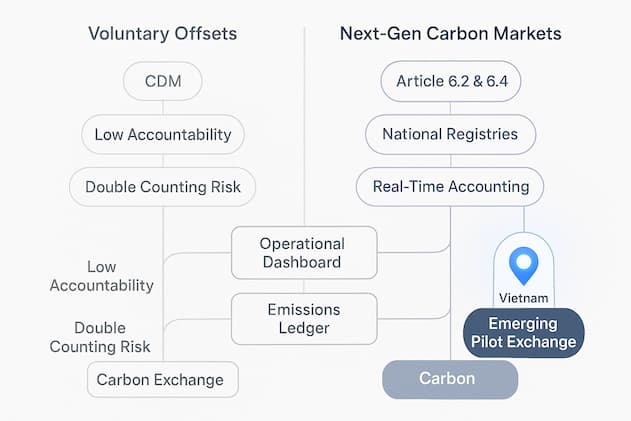

The Evolving Carbon Market Landscape

Carbon markets have transformed dramatically over the past decade, moving from voluntary initiatives to increasingly regulated systems with significant financial implications. Key developments include:

- Regulatory Expansion: More jurisdictions implementing mandatory carbon pricing mechanisms

- Market Maturation: Increasing standardization, liquidity, and financial instrument sophistication

- Corporate Net-Zero Commitments: Growing pressure from investors, customers, and employees for meaningful climate action

- Supply Chain Integration: Carbon considerations extending beyond direct operations to entire value chains

These developments mean that carbon management is no longer just an environmental concern but a core operational and strategic consideration for forward-thinking organizations.

Building an Effective Carbon Management System

A comprehensive carbon management system integrates several key components:

1. Carbon Accounting Infrastructure

The foundation of any carbon strategy is accurate measurement. This requires:

- Data Collection Systems: Automated gathering of activity data across operations

- Calculation Methodologies: Standardized approaches aligned with GHG Protocol or similar frameworks

- Verification Processes: Internal and external validation of emissions data

- Reporting Mechanisms: Regular, transparent disclosure of carbon performance

Organizations should aim for systems that balance comprehensiveness with practicality, focusing first on material emission sources while building capacity for more detailed accounting over time.

2. Carbon Reduction Workflow

Beyond measurement, organizations need systematic approaches to emissions reduction:

- Hotspot Analysis: Identifying high-impact areas for intervention

- Abatement Planning: Developing specific, time-bound reduction initiatives

- Implementation Frameworks: Clear processes for executing reduction projects

- Progress Tracking: Monitoring and reporting on reduction achievements

Effective carbon reduction workflows integrate with existing operational processes rather than functioning as separate sustainability initiatives.

3. Market Engagement Strategy

For emissions that cannot be immediately reduced, organizations need strategies for carbon market engagement:

- Offset Portfolio Management: Developing criteria for high-quality carbon credit purchases

- Risk Management: Hedging against price volatility and regulatory changes

- Opportunity Identification: Exploring potential for generating carbon credits from internal projects

- Strategic Partnerships: Collaborating with suppliers, customers, and industry peers on carbon initiatives

The most sophisticated organizations are moving beyond simple offset purchases to integrated strategies that align carbon market activities with broader business objectives.

Operational Integration Challenges

Implementing effective carbon management systems presents several operational challenges:

1. Data Fragmentation

Carbon-relevant data often exists in siloed systems across finance, facilities, procurement, and logistics. Creating unified data flows requires cross-functional collaboration and potentially significant system integration work.

2. Capability Gaps

Many organizations lack internal expertise in carbon accounting, market mechanisms, and reduction strategies. Building this capability requires investment in training, recruitment, or external partnerships.

3. Decision-Making Structures

Carbon considerations often cut across traditional organizational boundaries, requiring new governance structures and decision rights to ensure effective management.

4. Investment Frameworks

Traditional capital allocation processes may not adequately value carbon reduction benefits, necessitating revised investment criteria that incorporate carbon pricing and other climate-related factors.

Case Study: Manufacturing Sector Carbon Management

A global manufacturing company with operations in 12 countries implemented a comprehensive carbon management system with these key elements:

- Centralized Data Platform: Integrated energy, production, and logistics data into a single carbon accounting system

- Decentralized Reduction Ownership: Assigned carbon budgets to facility managers alongside traditional financial budgets

- Internal Carbon Pricing: Implemented a $50/ton shadow price for capital allocation decisions

- Strategic Offset Program: Developed long-term partnerships with offset providers aligned with their geographic footprint

Results included a 22% reduction in absolute emissions over three years, $15 million in energy cost savings, and significant improvement in ESG ratings that unlocked preferential financing terms.

Implementation Roadmap

Organizations looking to enhance their carbon management capabilities should consider this phased approach:

Phase 1: Foundation Building (3-6 months)

- Establish carbon accounting methodology and data collection processes

- Conduct initial emissions inventory focusing on Scope 1 and 2

- Develop carbon governance structure and responsibilities

- Set preliminary reduction targets based on industry benchmarks

Phase 2: System Development (6-12 months)

- Implement automated data collection for key emission sources

- Expand inventory to include material Scope 3 categories

- Develop detailed abatement plans for major emission sources

- Create carbon criteria for procurement and capital allocation

Phase 3: Advanced Integration (12-24 months)

- Fully integrate carbon data with enterprise management systems

- Implement internal carbon pricing across all business decisions

- Develop sophisticated market engagement strategy

- Align executive compensation with carbon performance

Conclusion

As carbon markets continue to evolve and expand, organizations that develop robust operational systems for carbon management will gain significant advantages—from regulatory compliance and risk mitigation to cost reduction and brand enhancement.

The most successful approaches will be those that treat carbon not as a separate sustainability initiative but as an integrated business consideration that informs strategy, operations, and financial decision-making.

By building comprehensive carbon management systems now, organizations can position themselves for success in the rapidly emerging low-carbon economy—turning what many see as a compliance burden into a source of competitive advantage.